2025 was not a year in which fashion competed over who looked better. It was a year in which the industry competed over who would survive, in a world where tariffs fluctuate, consumers think twice before buying, and major fashion houses reshuffle creative directors so frequently that even seasoned runway-goers needed a moment to catch their breath.

Report by Kai Manit

1. Trump Tariffs: When Fashion Was Forced to Rethink Pricing from the Ground Up

Trade policy once again sent shockwaves through the fashion industry in 2025. The re-emergence of Trump-era tariff strategies placed renewed pressure on apparel and footwear brands, forcing serious reassessments of supply chains, sourcing strategies, production costs, and, most critically, price architecture.

Throughout the year, leading fashion and business publications repeatedly identified tariffs as one of the industry’s most pressing concerns. The impact was tangible. Business of Fashion reported that platforms such as Shein and Temunotified customers of price increases beginning in late April, driven by mounting import costs and regulatory pressure. Shortly after, sales in the U.S. market showed signs of decline following the tariff shock.

The lesson of 2025 was clear: “cheap” is never permanently cheap when the rules of the game change.

2. Prada Group Acquires Versace for €1.25 Billion: Italy Rewrites the Rules

Prada Group’s acquisition of Versace from Capri Holdings for €1.25 billion marked one of the most consequential luxury deals of the decade. More than a financial transaction, it signaled a strategic shift: Italian fashion was no longer content to play by old rules.

Scale, portfolio strength, and operational structure became essential weapons in the global luxury arms race. By late 2025, reports confirmed that the deal had officially closed, but the real work had only just begun.

Rebuilding Versace under Prada’s stewardship is a long-term project. Signing contracts takes a pen; reviving a brand takes time, and the right people. Following the debut (and sole) collection by Dario Vitale, industry insiders began asking difficult questions: Would Versace become more restrained? Sharper? More refined? Or would it preserve its unapologetic glamour and sex appeal?

The central challenge remains restoring commercial momentum without erasing the brand’s DNA. As speculation continues, industry sources increasingly point to Pieter Mulier, former Raf Simons protégé and current creative force at Alaïa, as a potential future creative leader.

3. Anna Wintour: The Soft Step Back

One of the most closely watched media stories of the year was Anna Wintour’s step back from her role as Editor-in-Chief of Vogue US. While she continues to oversee Vogue globally, her withdrawal from day-to-day editorial control marked the end of an era.

The shift to a Head of Editorial Content model represents a move away from the one-person gatekeeper era toward a more structured, system-driven editorial leadership. After an extensive search, Vogue appointed Chloe Malle as Head of Editorial Content for American Vogue, tasking her with leading both print and digital platforms.

The message was unmistakable: Vogue’s future is inseparable from a serious, multi-platform strategy. With the final headline-grabbing cover featuring Timothée Chalamet in a cosmic visual universe now behind us, the industry is watching closely to see how Vogue’s voice, and authority, will evolve across all platforms.

4. AI in Fashion Is No Longer Optional: From Experiment to Revenue Engine

If 2024 flirted with AI, 2025 committed.

Fashion technology this year became decisively ROI-driven. From AI-powered search and commerce to virtual try-ons and creator storefronts, brands were forced to rethink discovery and conversion as search behavior began shifting away from traditional SEO toward AI-led interfaces.

One of the most discussed case studies came when Zara (Inditex) deployed AI-generated imagery built upon scans of real models. According to Reuters, the company emphasized consent and compensation, but the move ignited industry-wide debate.

This marked a turning point: the ethics of AI-generated fashion imagery, and its implications for photographers, models, stylists, and production crews, could no longer be ignored. The question was no longer if AI would be used, but how responsibly.

5. The Great Creative Reset: Why 2025 Became the Most Disruptive Year for Designers in Modern Fashion

At first glance, 2025 may be remembered as the year designers changed jobs en masse. Look closer, and it becomes clear that the entire industry was undergoing a necessary reset.

This wave of creative director changes was not driven by aesthetic fatigue. It was driven by three converging pressures:

global economic uncertainty, structural shifts in luxury business models, and a more discerning consumer base.

Fashion has moved from the era of the designer as superstar to the era of the designer as brand strategist.

During the 2010s, fashion revolved around personalities, Alexander McQueen, Karl Lagerfeld, Phoebe Philo, Virgil Abloh, Demna. Designers were icons, narratives, and marketing engines all at once.

By 2025, that model was no longer sufficient.

Luxury growth slowed. Costs increased. Consumers asked harder questions. Social media could no longer guarantee sales. Brands no longer searched for designers who could deliver viral moments; they needed leaders who could command brand language, product coherence, and long-term business continuity.

Kering: A High-Stakes Cultural Reset

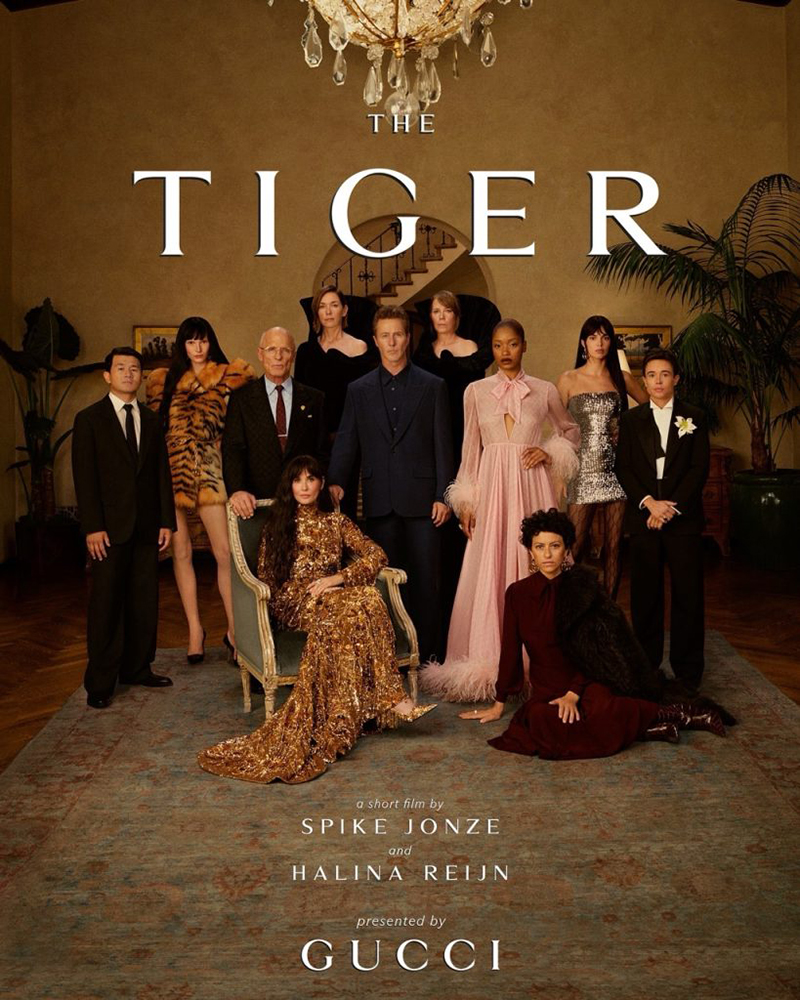

The appointments of Demna at Gucci and Pierpaolo Piccioli at Balenciaga were the clearest strategic moves of the year.

Gucci chose Demna not for shock value, but for his ability to deliver cultural impact strong enough to pull the brand out of strategic drift. Balenciaga, meanwhile, selected Piccioli to pivot away from shock-driven fashion toward emotional luxury and couture-level dignity.

Together, these moves signaled Kering’s intent to rebalance its entire portfolio.

LVMH: Designers Who Can Run the Whole System

At LVMH, the appointment of Jonathan Anderson at Dior sent a clear message. Dior was no longer looking for a designer who could simply make beautiful clothes, it needed a leader capable of unifying womenswear, menswear, and couture under a single creative language.

The same logic applied at Loewe, where the group selected Proenza Schouler’s Jack McCollough and Lazaro Hernandez, designers proven to build brands, not just imagery.

In an era where fashion houses function as complex systems, designers must now think like cultural CEOs.

Chanel: The Most Delicate Transition of All

The arrival of Matthieu Blazy at Chanel represented the most sensitive creative transition in the industry. Chanel cannot afford missteps.

The task is not to be radically different, but to be contemporary without destabilizing global consumer trust. This is why some designer changes today rely on silence rather than spectacle.

Versace: Ownership Does Not Guarantee Stability

Versace’s post-acquisition period under Prada Group illustrates a central truth of modern fashion: even with strong ownership, balancing heritage with new business structures is never simple.

An unsettled creative chair is not a failure, it is a symptom of transition.

Conclusion

2025 marked the year fashion stopped asking, “Who is the most talented?” and began asking, “Who can actually take the brand forward?”

Designer changes are no longer drama, they are survival mechanisms. From this point forward, the role of Creative Director is no longer a stage for performance, but a seat of responsibility, one that must answer to the past, the present, and the future of a brand.