#style / #watches & #jewellery

Horological Auctioneer Aurel Bacs Talks Independents and the Future of Watches

BY #legend

January 29, 2016

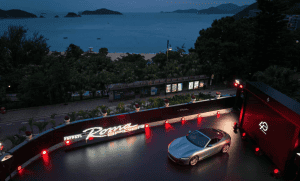

Swiss watch authority Aurel Bacs has worked as an auctioneer at several top houses since 1995, most recently as the head of watches for Christie’s. He went on to set up consultancy Bacs & Russo with wife Livia Russo, also a watch expert, and is now an independent adviser to collectors, manufacturers and museums on fine watches, and an exclusive consultant for Phillips. We spoke with him shortly before Phillips’ inaugural watch auction in Hong Kong, where Bacs sold a Patek Philippe for US$1.55 million – the highest price paid for a wristwatch at auction in Asia.

Independent watchmakers like FP Journe, Roger W Smith, MB&F seem to be having a moment. Would you agree?

I do. But let’s zoom out and look at the entire haute horlogerie industry. No one needs a US$100,000 mechanical timepiece. Nobody needs a Rolls-Royce, nobody needs to drink a fine 1982 Bordeaux. Simultaneously, we don’t need art, but you understand…I’m playing devil’s advocate. In a nutshell, this is, I think, what mankind is all about. It is culture and the need for intellectual or emotional stimulation. And high-end watchmaking and collecting is a signature activity of mankind. So once we’ve figured out that you don’t need a minute-repeating watch, but that you would still like to have it, the question is, “Why would you like to have it?” Whether you admire the craftsmanship, the ingenious engineering, the exclusivity, or knowing that you have a watch made for you, or was made in only five or 10 examples. Then you understand why the independents are so successful.

How do you factor independents into the auction world of established players like Patek and Rolex?

They are perfectly complementary. It’s about the right thing at the right moment. A collector will say: “On Monday I’ll wear Rolex, on Tuesday I’ll wear Vacheron Constantin,on Wednesday an FP Journe.” It’s based on their mood, surroundings and their activities. So it’s a necessity. Now why are they popular at auction? FP Journe or Richard Mille, they made a number of limited editions, sometimes just five, which often sold out the day they were presented. So what if you’re a collector, you couldn’t get your hands on one and you’re given a second opportunity at auction? It’s a great way, on one hand, for the seller to say: “I want to move on. I’ve had it for five years, I’ve enjoyed it but I don’t have unlimited means, I don’t have space, and I need to restructure my collection.” And simultaneously, a buyer can say, “Here’s my second chance.” It’s a very natural fit.

How aficionado is the Asian market compared with 1995?

One, the world has grown. Twenty years ago, a good auction was 200 watches with 15 bidders in the room from 10 countries; mainly Europeans, the US, Japan, Hong Kong and Singapore. That was the watch-collecting world. Today, a good auction is 1,000 bidders from 40 countries. So the watch population has grown, and that is great news. It means more diversity, stability, more demand, and where once five limited-edition watches had to be divided between 50 bidders now it’s more than 1,000.

A second reason, nothing to do with globalisation, is the degree of knowledge. Today, thanks to a number of publications, print, online, collector meetings, collector clubs, books, communication is at its best. There is a degree of transparency and a degree of documentation that gives confidence to bidders. That understanding has boosted confidence and the growth of the market has ensured that, from an economic standpoint, collectors’ watches are now very good – I wouldn’t say investments – but havens to park US$100,000, enjoy them for a few years, and move on, without having the same level of depreciation as with electronics or your average motor car.

What’s your advice to young collectors who don’t have the budget or know-how to participate in the auction market?

Many people read about world records – millions here, millions there, we just sold a Patek Philippe this spring for US$7.3 million – so they forget that at an auction like the one [in Hong Kong on December 1] there are really nice collectors’ watches at US$5,000. Often, the best collector is not the one with the deepest pockets but the one with the best knowledge. And there my advice is to inform yourself. Go online, but that doesn’t mean everything you google or yahoo is automatically correct. Go to a trusted source; a manufacturer, the auction house and its specialists, or a friend who’s an experienced watch collector.

What are the most underrated brands due a resurgence, or new/upcoming brands likely to see strongest growth?

I don’t have a crystal ball. But we can establish rules. First, look at the brand itself. What is their approach to doing business – does it change direction? The brands most faithful to their DNA, heritage and original idea win hearts because people know what they stand for. The same with quality. The biggest mistake a manufacturer can make is say: “We won’t hand-finish our movements any more so we can be more competitive.” Collectors don’t care to get a watch for 20 percent less. They do care when a watch does not keep the promise made by its maker. Next is uniqueness. By that, I don’t necessarily mean how many pieces they produce. If I see a watch on someone’s wrist across the room, can I say: “That’s a Patek Philippe, that’s a Rolex, that’s a Richard Mille.” Meaning, are they just trying to take a little bit of everything and at the end you don’t know their character?…Quantities – if there’s more on the market than the market can absorb there is a problem. Suddenly there are discounts, parallel markets and they come to auction at a fraction of retail…There’s also innovation. Some brands don’t innovate but perfect what is already on the market…If a new 25-year-old watchmaker launches a new brand, here’s my advice; think where you want to go and follow these parameters.

I have US$50,000. What’s a solid horological investment now?

The word “investment” has to be defined and understood. My first hope is that someone who buys a watch for US$50,000 as an investment considers the dividend, the pleasure, the intellectual and emotional stimulation he/she gets by wearing it daily, weekly and year-long. If it’s purely, “What am I buying today to sell for 10 percent more in 12 months”, that’s another type of investment…My advice is to take an auction catalogue and try to understand what you actually like. Be yourself. The watch has to fit your personality. Once you’ve decided you want a vintage Rolex, do your homework and assess the criteria, the pitfalls and specialists in the field. And then talk to them. My advice would be overpay 10 percent or 20 percent if that’s the watch you need to be happy, rather than trying to make a bargain, cutting corners and realising it wasn’t what you wanted.

Personally, what is the most important watch in your life?

I have two horological lives, private and professional. In my private life, it’s not the most valuable but the watch that is connected, or a group that are connected, to dear friends, beautiful memories, highly important moments in my life. I have at least three watches that would make the last three I would ever agree to part with. And one is an IWC I received when I was 12, my first real watch. One is a Patek Philippe that I bought with my own money. In order to buy it, I had to ask my parents for a loan and it took me two-and-a-half years, with monthly down payments, to own it. The third my wife offered me in late 2013, with an inscription on the back, that marked a very important moment in my life – when I gave up possibly the most prestigious position you can have in the collectors’ world, which is leading the world’s largest, most powerful and most prestigious watch department in the industry without knowing what, on January 1, 2014, I was going to do. The inscription reads: “For every door that closes, a new one will open.” And, well, now we’re sitting in Hong Kong, so a new gate did open.

What’s your daily wearer?

I don’t have a daily watch but, statistically speaking, the most worn is my trusted Nautilus. To me it’s an icon, highly functional, timeless design, comfortable, it does everything I need on a daily basis, it’s automatic and robust. I never feel over- or underdressed with it. The quality is brilliant.

Are horology’s best days behind it? Can we still match/surpass the innovation/design triumphs of times past?

I hope and I believe so. Who would have thought in the 1950s that somebody would invent a steel sports watch? Gerald Genta did it in 1972 with the Royal Oak, and revolutionised the concept of a luxury watch. The independents continue to do so. There are multiple evolutions with material – witness the first titanium wrist watch. There are so many ways of surprising us today, and I encourage all watchmakers and wish them luck in achieving that.